Home Loan Renovation Calculator | Find Your Renovation Cost

Articles, products, and services offered on this site are for informational purposes only. We are part of the Amazon Services LLC Associates Program, an affiliate advertising program. Amazon.com is compensated for sales resulting from links on our website.

Please review our disclaimer before acting based on anything you read or see.

The majority of the time, making a new house or your first home will involve some labor. Renovations are a normal aspect of house ownership and, with a little forethought, may also be financed as part of your mortgage. Consider taking out the cash up front rather than delaying your first restoration project for years or utilizing your hard-earned savings. Remodel borrowings come in many forms and colors; Thus, we have made this post on the home loan renovation calculator.

A loan for home improvements might help you realize your living room goals. Families may need help locating the ideal house with adequate room and facilities in the ideal area. Growing families’ tight budgets may force you to settle for smaller houses in less desirable neighborhoods.

Because of this, regular people are resorting to a home renovation loan, which enables them to consider bigger, cheaper properties that require work. To buy a house in a desirable region for less money, a remodeling loan might be of great use. If you’re one of the many individuals living on a tight budget, knowing how a renovation loan works will help you choose a house wisely. Come along as we highlight more on the home loan renovation calculator below.

Home Loan Renovation Calculator

What is a Home Renovation Loan?

A home-renovation loan is a form of loan that covers the expenses of restoring a fixer-upper and is sometimes bundled into a mortgage loan.

If you’re interested in purchasing a house at a cheaper price and taking on the renovation expenditures, consider obtaining one. There are many reasons why buyers choose to do this. This involves purchasing a home ready to move into for personal enjoyment or to build equity more quickly than they otherwise would. This is true since you have more power over determining the worth of your home.

Loans for home improvements may be used to pay for expenses like upgrading or modernizing cooling and heating equipment. This also covers roofing, waterproofing, mold removal, and energy upgrades. In addition to this, a new kitchen or bathroom may be the desired upgrade that might increase the home’s value.

A home remodeling loan evaluation may often include up to 110% of the house’s after-improved worth. This is especially useful if the house needs to delay the repair, such as a water heater with one to two years remaining to live.

How to Get a Home Renovation Loan?

Some procedures for obtaining a loan for house improvements include:

Assess your finances

You must grasp your financial situation before requesting any financing for home improvements. Overextending your borrowing capacity might have long-term detrimental effects on your financial situation.

Make your ambitions affordable.

If your finances are limited, you should change your plans. As much as possible, spread out your project and work on one component of the whole at a time. You will reduce your financial risk and the loan amount required.

No one wants to scale down their home remodeling ambitions due to a lack of funds. However, taking on debt above your means is risky, whether it agrees to a high-interest rate or large monthly payment.

Compile your paperwork.

The loan application will make the necessary paperwork very obvious. Some things are, nevertheless, very commonplace. These consist of the following:

- Government-issued picture identification

- Social Security number • Income documentation in the form of tax returns and recent pay stubs

- Employer contact details

- Residence documentation

Apply for a loan

You’ve done your research, prequalified for the offer, and are ready to begin applying.

However, generally speaking, you may anticipate to:

- Complete the lender’s online application by completing the form on the lender’s website

- Submit any required papers, such as proof of income and contractor plans

- Accept the given interest rate and loan conditions

- Submit any further paperwork required by the lender

Examine and agree to the loan closing terms. Pay advance closing expenses, if necessary. Receive money through the chosen payment method, such as a bank account.

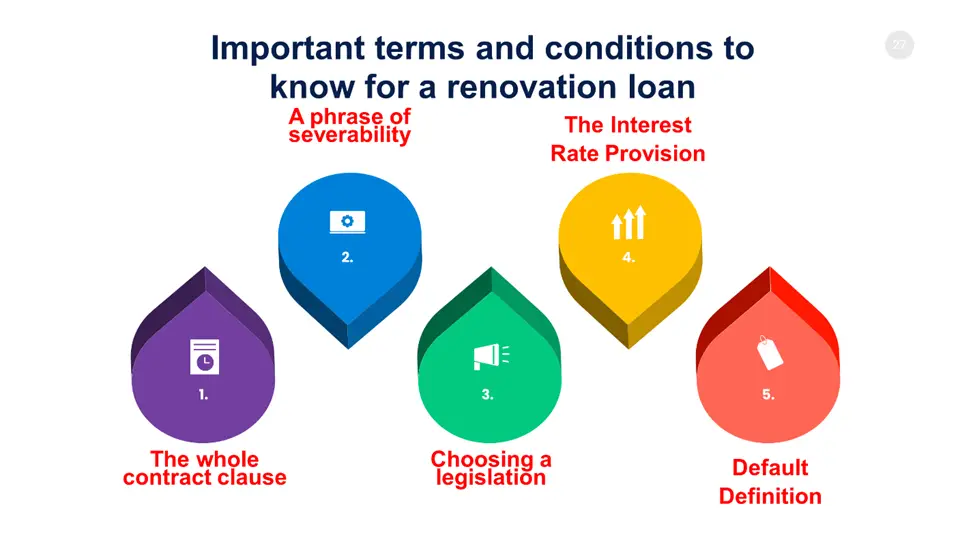

Important Terms and Conditions to know for a Renovation Loan

Some Important terms and conditions to know for a renovation loan include the following:

The whole contract clause

According to this paragraph, all prior written or oral deals made during negotiations are superseded by the final agreement.

A phrase of severability

According to the severability clause, each provision of the agreement stands alone. This implies that even if a provision of the contract is found to be invalid, the other terms will still be enforceable.

Choosing a legislation

This establishes the laws of the state or jurisdiction that will apply to the agreement.

The Interest Rate Provision

This provision allows the lender to adjust the interest rate in response to fluctuations in the RBI-determined Marginal Cost of Funds-based Cost Of borrowing. Always check to see how effectively the interest rate is shielded.

Default Definition

The circumstances and repercussions of your defaulting are described in this section. This may occur if you miss an EMI payment deadline or are engaged in illegal activity.

What Credit Score do you need to Renovate a Home Loan?

When requesting a home renovation loan, it is desirable to have at least excellent credit. Therefore, you should check your credit score as soon as possible. Here is how FICO divides down its credit score groupings so you may get a sense of where you would like your score to be:

- Outstanding: 800 to 850

- Very good: 740–799;

- Good: 670–739;

- Fair: 580–669;

- Poor: 300–579

Additionally, you must ensure that you have proof of income through pay stubs, W-2s, or, if you’re self-employed, bank records and most recent tax returns.

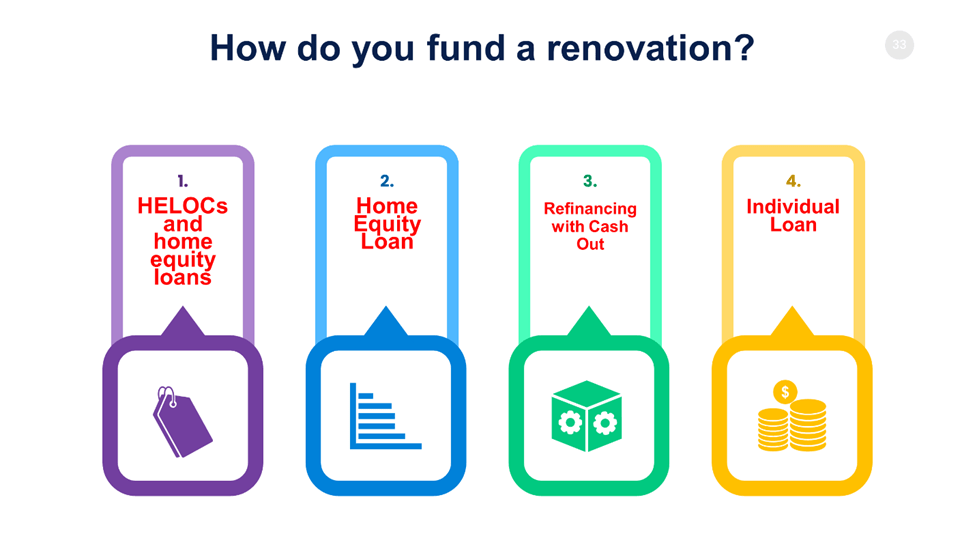

How do you Fund a Renovation?

You may fund significant improvements with the aid of a home improvement loan. However, it would help if you first chose the loan kind that is most appropriate for you before you apply. Several possibilities are:

HELOCs and home equity loans

A remortgage in the form of a reverse mortgage or home equity loan is one of the most popular methods to fund home upgrades.

Both are geared for homeowners with at least 20% property equity, and the house serves as security for the loan. Therefore, compared to other loan types, particularly unsecured loans, home equity financing and lines of credit often have lower interest rates.

Home Equity Loan

Borrowers get a set interest rate and the whole loan amount up front with a home equity loan. You can have five to thirty years to pay back the loan based on the terms.

Homeowners who want to pay off their debt over a long time are best suited for home equity loans since the interest rates are set for the duration of the loan. They’re also great for borrowers with a single home improvement project and no debt to revolve over.

Refinancing with Cash Out

With cash-out refinancing, your current mortgage will be refinanced, and you will effectively get a check for the sum you wish to cash out rather than taking out a private mortgage.

The original mortgage balance, the cash-out sum, and any closing expenses you may have incorporated into the loan will all be included in your new loan.

Individual Loan

With a personal loan, you may very much finance whatever you desire, even home renovation projects, depending on the lender.

Since personal loans are often unsecured debt, you don’t need to use your property as collateral and jeopardize your right to own a home. A personal loan may be obtained without having a certain level of equity in your property. And even if your credit is just fair, you may be able to get a good interest rate.

Should you get a Loan to Renovate your House?

Yes. Getting a loan could be the best line of action if you’re already considering how to get money for your home remodeling.

And if your credit is fair and you may not qualify for a good rate, you can ask a relative or a friend for a cheap loan while you work on repairing your credit.

Frequently Asked Questions

Can renovation be included in a home loan?

Yes. A loan that includes money for house remodeling, repairs, and renovations is known as a home renovation loan.

Which loan is best for a house renovation?

The FHA 203(k) loan may be the finest renovation financing if you’re purchasing a fixer-upper or remodeling an older property (k). You may finance or restructure the cost of the property and the renovations into a single loan using a 203(k)-rehab loan to avoid paying two closing charges and interest rates.

What is the maximum renovation loan?

That differs for various projects, lenders, and programs. You may often borrow up to the future worth of the house if you’re utilizing a renovation loan to purchase and improve a property. Its expected price after improvements is this. However, your loan amount will need to decrease to comply with local FHA or conforming loan requirements.

How much will a bank lend me for a renovation?

This relies on the kind of renovation loan you’re thinking about and the worth of your house following remodeling. This is in addition to, among other things, your solvency and the outstanding sum on your mortgage.

What documents are required for a home renovation loan?

Among the paperwork needed for a loan for house renovations are:

- Proof of identities, such as a driver’s license or passport;

- Income documentation such as W-2 forms, tax returns, and current pay stubs

- Contact details for the employer • Documentation of the residence, such as power bills or mortgage documents

Can I use a home loan for interiors?

Usually not. Instead, you may divert part of the funds intended for the down payment on the property to the inside, as much of the loan as you can use to pay the builder.

Are renovation loans worth it?

Yes. Taking out a home renovation loan is worthwhile if you can make the payments on schedule. You only need to consider that while applying for an unsecured personal loan. Additionally, regular repayments will progressively raise your credit score if it is already low.

Expert Opinion

Home improvement initiatives may raise your home’s equity and enhance your quality of life. These advantages and the actual method of funding your home improvement are of utmost significance.

Loans for home renovations may perform a variety of tasks and operate in a variety of ways. Thus, you’ll need a home loan renovation calculator for more ease.

Comments are closed.